SUMMARY

Enrolling in your employer-sponsored retirement plan can feel overwhelming and tempting to put off, but young professionals have the one commodity you never get back: time. Here, we dive into what young professionals should know about contributions, maximizing your employer match and more.

When you get your first full-time job, your mind is probably swimming with all the new financial responsibilities of being an adult — security deposits, rent, student loans and even buying a new car — and the thought of saving for a far-distant retirement may not feel like a priority. This couldn't be further from the truth.

The reality is young professionals have the one commodity that they can’t ever get back: time. When it comes to participating in a retirement plan, starting early can set you up for success down the road, and the longer you delay, the more money and energy you’ll have to commit further down the line to catching up. Because of compounding interest, your money can earn money over time, which is why it's critical to start saving for retirement young.

Here, we dive into some of the questions you might be wondering about your retirement plan.

What is a retirement plan?

A retirement plan is defined as an employer sponsored, savings and investment arrangement. It allows employees to dedicate a portion of their paycheck in either a pre-tax or a Roth after-tax investment contribution strategy; as well as select an investment portfolio that meets their goals to fund their future retirement.

How do I enroll?

On your first day at your new job, you’ll most likely be handed a huge packet of information that outlines all the benefits of your job. A retirement plan, such as a 401(k) or a 403(b), is a portion of your benefits package, just like your salary or your health insurance. However, this portion of your benefits package is different in that it allows you to save for your future goals.

For most people, it'll be most advantageous to sign up for your retirement plan right away. Nowadays, signing up is easy — most record keepers allow you to sign up via an online portal or a mobile app. Some plans even have an auto-enrollment feature, which allows your employer to automatically deduct deferrals from your paycheck unless you opt out of contributing. But before you finalize the enrollment process, there are a few important considerations that you’ll need to make.

How much should I contribute?

When first considering how much to contribute, always start with your employer match, if one is offered. If you contribute less than the match, you're leaving money on the table. Every company’s employer contribution is a little bit different, so you will need to review your plan documents to know what your match is.

When you get a raise, a bonus or have some other change to your income, it's a great time to up your retirement contribution. If your lifestyle is working before your change in income, you can probably afford to increase the amount that you're saving for retirement. Your first priority should be building your contribution up to 10%. After you raise your contribution to 10%, you can work your way to a 15% contribution, and once you reach 15%, you may want to consider diversifying and investing in a Roth IRA or a business venture.

One additional piece of information to keep in mind is that the IRS sets annual contribution limits for employer-sponsored retirement plans. For example, in 2024, the maximum contribution limit for 401(k) and 403(b) plans is $23,000 for those under 50. If you have a different type of plan, make sure to check the maximum contribution limit for your plan type.

How do I maximize my employer’s contribution?

To maximize your employer’s contribution, you need to understand what types of employer contributions are out there. Your employer may contribute in one or more of the following ways to your retirement plan:

- Employer match – Your employer matches your contribution up to a certain percentage of your salary. You must contribute to your retirement plan to receive the match.

- Discretionary contribution – Your employer contributes a certain dollar amount based on a percentage of your overall salary, if the funds are available. This amount is contributed regardless of your rate of contribution to the retirement plan.

- Profit sharing – Your employer contributes based on the profitability of the organization. This amount is contributed regardless of your rate of contribution to the retirement plan.

If your firm has an employer match, it's advantageous for you to always contribute at least the amount that gets your full match. If, on the other hand, your firm contributes via profit sharing or discretionary contributions, there's no minimum contribution on the part of the employee to maximize these contributions.

It's also important to understand what it means to be “vested” and what your vesting schedule is. Vesting is just another word for ownership. If you stay at your current company until you're vested, you will get to keep the employer contributions to your retirement. However, if you leave before you're vested, you will only keep the amount that you contributed.

Should I prioritize pre-tax or Roth after-tax contributions?

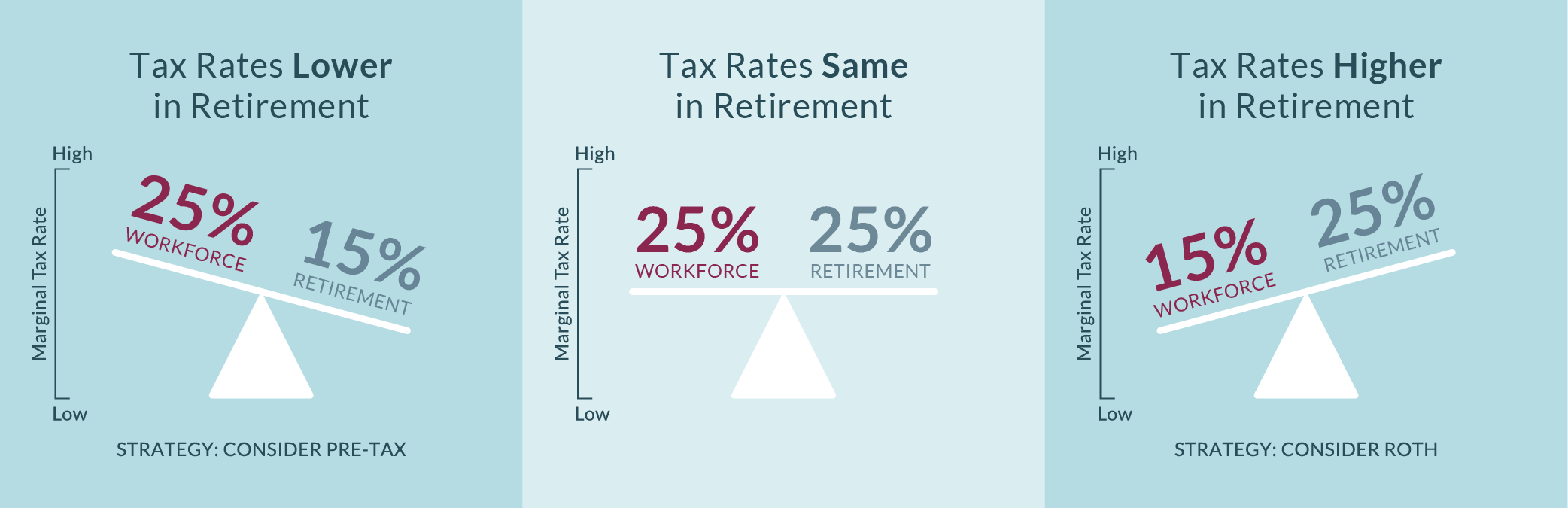

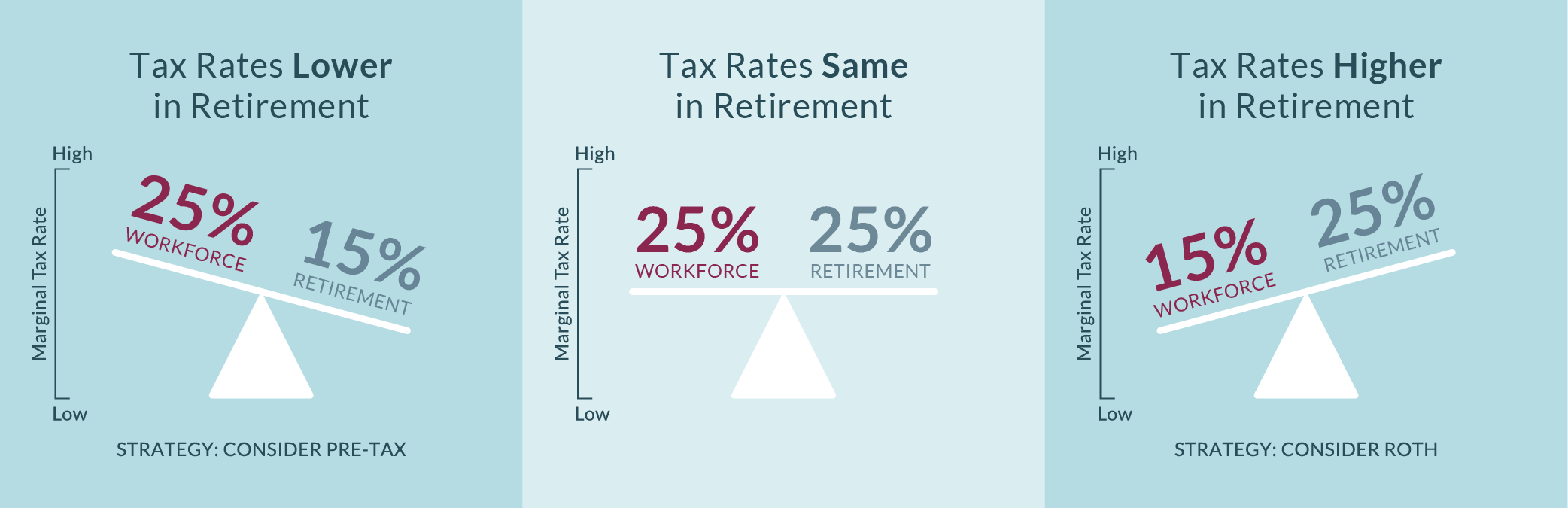

The traditional 401(k) is funded with pre‐tax tax dollars, which lowers current income, while the Roth 401(k) is funded with only post‐tax dollars. When setting up your retirement plan, you often have the choice between contributing to a traditional 401(k) and a Roth 401(k). Whether you decide to prioritize pre-tax or Roth after-tax contributions boils down to tax efficiency and your personal situation.

For those who believe that their income tax rate today is higher than it'll be during retirement, you may want to consider pre-tax contributions. With these contributions, your money will grow tax-deferred, and taxes will only be taken when you start to withdrawal.

On the other hand, Roth after-tax contributions make the most sense for someone who believes their current income tax rate is lower than it'll be during retirement. By contributing after-tax, you will have no tax liability on your retirement assets when you start to withdrawal.

Should I manage my own money or use a target-date fund?

There are two types of retirement investors: hands-off and hands-on. Some people want to take the time to learn about investing and take their retirement investing into their own hands, while others have little time or desire to spend their time researching investment options.

The vast majority of people don't want to take on the added stress and task of managing their retirement portfolio. For some people, it makes sense to take advantage of a Target-Date Fund. Target-Date Funds take a lot of the hard work out of investing. These funds are managed by investment professionals and allow everyday investors to “set it and forget it.” Depending on your expected age of retirement, the managers of these funds will adjust the strategy to hopefully prepare your portfolio for your targeted retirement date.

For some other hands-off investors, it might make sense to work with a financial advisor, who will help manage your retirement portfolio as part of their work on your financial plan. Your financial advisor can select allocations of your investment that meet your goals and risk tolerance and can help you understand and maximize tax benefits.

However, if you're in the small minority of investors who want to invest your retirement savings on your own, don’t underestimate the amount of time and work it'll take to manage your portfolio. You’ll need to stay up to date on the market and commentary around investing regulation changes. If you decide to invest on your own, you need to actively take part in managing and updating your retirement portfolio as the market changes.

What next?

Getting started with your retirement plan is a big step towards a secure financial future, but navigating all the details can be tricky. If you have any questions, a Johnson Financial Group financial advisor can help answer your questions and help you make a plan for your financial future.