Plan Sponsor Services

At Johnson Financial Group, we are forward-thinking in our approach to managing retirement plans.

Investment products: are not insured by the FDIC; are not deposits; and may lose value.

At Johnson Financial Group, we are forward-thinking in our approach to managing retirement plans.

As fiduciaries, we help you understand and meet legal and regulatory requirements.

As advisors, we leverage data to help you choose the right platform, assemble the right investment line-up, and efficiently manage your plan.

As educators, our commitment to employee financial wellness through education and advice aligns with your goals of more satisfied, loyal, and tenured employees; helping support your business goals and delivering meaningful value to your organization.

As partners, we put the needs of your employees and your retirement plan first.

Our Approach

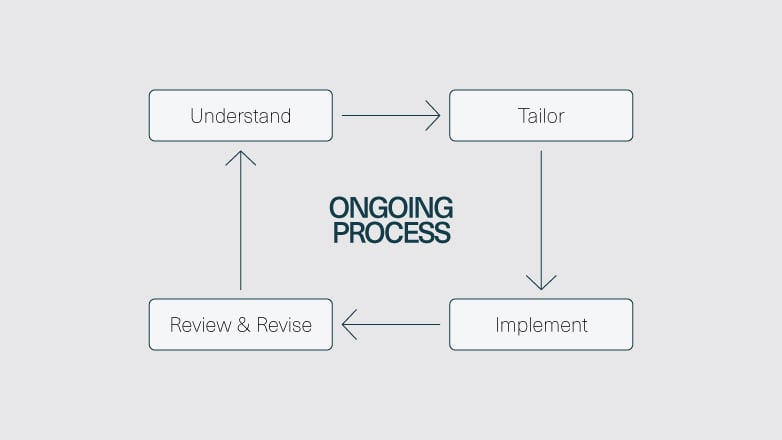

During a partnership with Johnson Financial Group, you can expect a comprehensive retirement plan process that includes the following key features:

- Discovery & Consultative Discussions: We conduct a baseline fiduciary analysis to understand your current situation and identify areas for improvement. We assess the strengths and opportunities of your retirement plan, aligning them with your short and long-term objectives.

- Plan Development: We create a plan that includes the best partner options and solutions to achieve your plan goals and objectives. The plan presents various engagement opportunities, empowering you to make informed decisions about the direction of your retirement plan.

- Plan Implementation & Ongoing Service: We assist you in implementing the chosen solution, establishing servicing needs and developing a financial wellness strategy. We continuously measure progress towards your goals and regularly review the suitability of our partnership.

How We Can Help

Managed Portfolios for Plan Participants

-

Investing can be scary for plan participants and can create anxiety that keeps them from engaging with your company’s plan.

Your plan’s Target Date Retirement Funds Series is a great solution for many employees that desire a less-is-more contact approach with their retirement savings. But for those employees that have more complex finances, defined goals, and specific investment strategies, our team can help.

We are now offering professionally managed portfolios as investment options for your employees at no additional cost to the Plan. Click here to learn more.

Defined Contribution Plans

-

Your employees may set aside pre‐tax or Roth dollars in their retirement account to be invested in funds chosen by you with our professional guidance. Contributions and earnings grow tax‐deferred.

- 401(k) retirement plans for employees

- 403(b) retirement plans for employees of public entities and nonprofit organizations

- Profit-sharing plans

Facilitation of Administrative Services & Recordkeeping

-

Our integrated professional administrative team streamlines the day-to-day operations of the plan, saving you significant time and energy while providing you with the personal attention you deserve.

- Plan design consulting

- Plan sponsor service, investment and fiduciary reviews

- Online plan participant and sponsor solutions

- Participant education promoting retirement readiness

- Enhanced reporting and communication

- Participant accounting flexibility

- Comprehensive compliance testing

- Government reporting

Employee Communications

-

Communicating with your employees about retirement planning can increase participation, deferral rates and appreciation for the benefit you're providing. Educated employees make better saving and investing decisions, increasing their retirement readiness and long-term happiness.

To keep your employees engaged, we use a variety of touchpoints.

- In-person group meetings and one-on-one discussions

- Electronic communications and behavioral outreach campaigns

- Robust online planning and projection tools

Managed Portfolios for Plan Participants

Investing can be scary for plan participants and can create anxiety that keeps them from engaging with your company’s plan.

Your plan’s Target Date Retirement Funds Series is a great solution for many employees that desire a less-is-more contact approach with their retirement savings. But for those employees that have more complex finances, defined goals, and specific investment strategies, our team can help.

We are now offering professionally managed portfolios as investment options for your employees at no additional cost to the Plan. Through this offering your employees will be guided through a process to select the most appropriate investment choices based on their unique individual factors.

LEARN MOREHow We Can Help

Our comprehensive approach to communication and education focuses on achieving plan-focused outcomes. Through tailored meetings and targeted campaigns, we drive increased plan participation, enhanced contribution rates, and improved investment decisions for measurable results. We partner with your organization in the following areas:

At Plan Eligibility

Our advisors will create a smooth enrollment process for your employees by providing:

- Tailored orientation packets and outline, interactive enrollment solutions

- A retirement needs assessment

- Savings and investment allocation guidance

Goal Setting & Income Projections

We'll work side by side with you and your organization to ensure your employees are on a better path to retirement by providing:

- Interactive online financial planning tools that go beyond retirement planning to engage users in a holistic approach to achieve long-term financial security

- A personal retirement income projection assessment tool

- Guidance and financial planning consultation

Ongoing Education & Communication

We'll design an approach based on your ongoing education and communication needs, considering demographics utilizing the following services:

- Interactive online resources for plan enrollment, education, and targeted outreach campaigns

- Quarterly performance updates

- Periodic education meetings (group and/or one-on-one)

- Participant call center

- Participant web-based tools

Plan Sponsor Education

Our team will align your organization's retirement plan with your strategic priorities through:

- Fiduciary education

- Regulatory updates

- Plan design consulting

Plan Participant Resources

As an important part of your company’s benefits package for employees, it’s critical that you have a partner to help with employee engagement and to assist with helping employees with their long-term retirement success. Learn more our approach to your participant’s retirement plan experience and enrollment process.

LEARN MORE about retirement plan resources.

Get Started Today

Partner with Johnson Financial Group and experience the difference of personalized advice that drives improved plan outcomes. Let us handle the complexities of retirement planning, so you can focus on what matters most – growing your business.

FIND AN ADVISORYour Trusted Retirement Plan Advisor

Our advisors work hard to ensure your retirement plan is tailored to fit the needs of your organization's overall benefit program.

FIND AN ADVISOR