Among investors, even those of us who haven’t actually read Dickens’ Great Expectations use the phrase regularly. Expectations are a fundamental driver of market prices.

In our 2024 Outlook, we wrote that returns this year would likely depend on (a ) whether optimistic expectations can be met, and (b) whether geopolitics or U.S. elections would put a dent in investor sentiment.

Expectations met and unmet

To date in 2024, expectations for economic growth have been met—and forecasts have even risen since the beginning of the year. Corporate earnings were better than expected as well, with stocks ending the quarter with 5-10% gains for various segments of the market. And since the October stock-market low that coincided with the peak in interest rates, the S&P 500 Index of large companies is up over 25%!

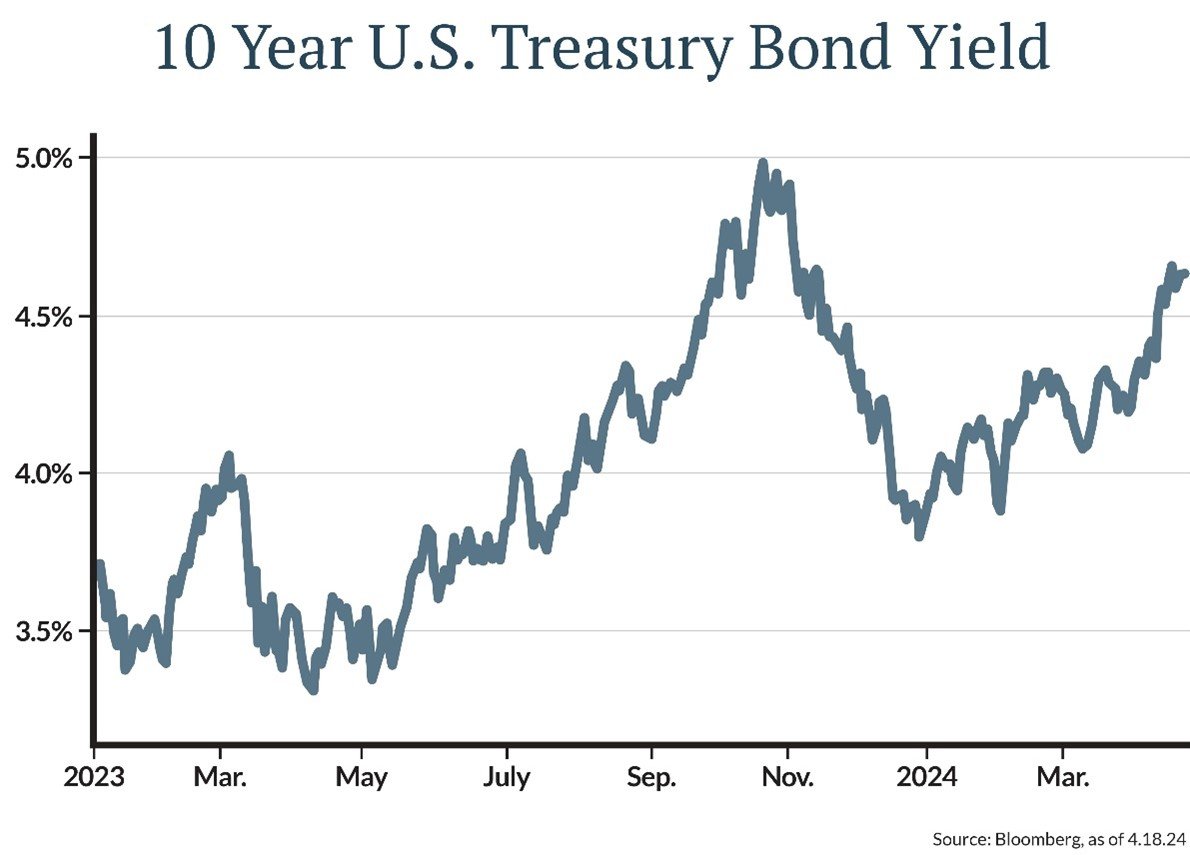

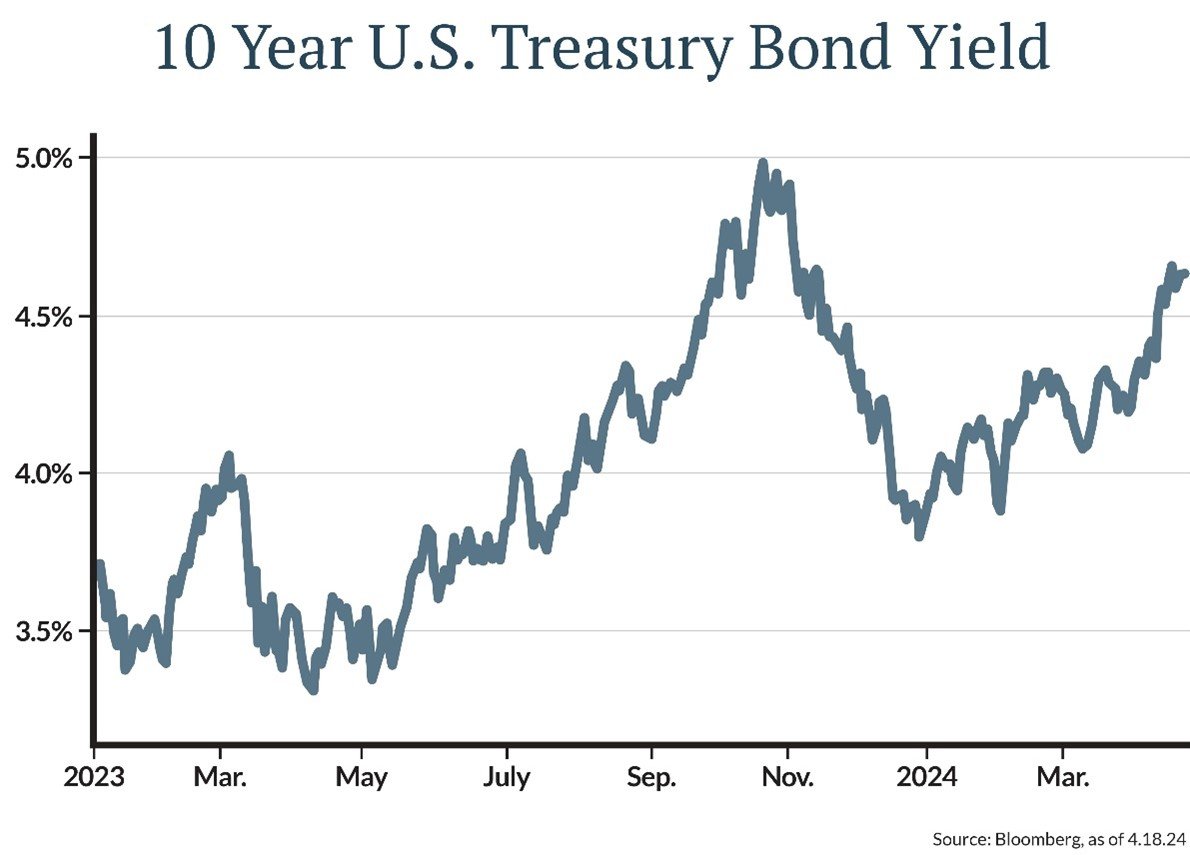

On the other hand, market expectations for Fed rate cuts were too optimistic. Markets now reflect one or two late-year cuts, down from 6-7 cuts just a few months ago. The change in expectations pushed the yield on the 10-year U.S. Treasury Bond higher by about 0.75 percentage points since the beginning of the year, to 4.65% in mid-April. In addition to causing bond prices to decline, higher rates have been a headwind to more rate-sensitive stocks including dividend payers and small-company stocks.

Geopolitical and election complications

On the geopolitical front, conflict in the Middle East escalated with Iran’s attack on Israel in mid-April. The momentum in stocks had already stalled in early April as interest rates moved higher, but the added risks from geopolitics triggered additional selling. Unless recession risks increase, the most probable outcome is that the current selloff is contained to a garden variety pullback of 5-10%. After a 25% rally in stocks and high expectations, any number of news items could have been the catalyst for profit taking.

We’ll spend more time on the election as the year progresses, but at this point markets haven’t focused there. In a typical presidential election year, stocks start the year with gains, move sideways or modestly lower as the election nears, and then rally as election uncertainty passes. This playbook aligns with how 2024 has started, but with a balance of bullish and bearish potential outcomes we do not recommend trying to time the market based on a limited number of historical observations.

Volatility doesn’t necessarily suggest change

Volatility has increased as markets incorporate new expectations about the timing of Fed rate cuts and heightened geopolitical risk. However, we do not believe these issues warrant drastic changes to investment portfolios. We will continue to focus on investing to meet your goals through disciplined rebalancing and selective tactical adjustments to manage risk and take advantage of opportunities as they come.