Investment Commentary

Financial Advisors Have Feelings Too

4 minute read time

A few weeks ago, I wrote a piece about the psychology of investing that focused on how emotional decision making reduces the chances of investing success. The antidotes to emotional decision making, I said, are process, planning, and preparation. By collaborating with a financial advisor to develop a financial plan, investors can create a roadmap, or framework for decision-making, which can withstand the inevitable challenges that life and markets throw in our path.

But our clients don’t just hire us to create financial plans. We are investors as well as planners, and we strive to bring the same discipline to our investment process that we bring to planning. This is because we recognize that financial advisors have feelings too. We want our clients to succeed, and when markets don’t cooperate, causing losses or underperformance, it can tempt even the most well-intentioned advisors to change course. This is when we remind ourselves to come back to our process, our research, and our core conviction that consistency pays off in the long run.

The Johnson Wealth Way

I’d like to share with you some of the key elements of our investment process that we believe lead to sustained success.

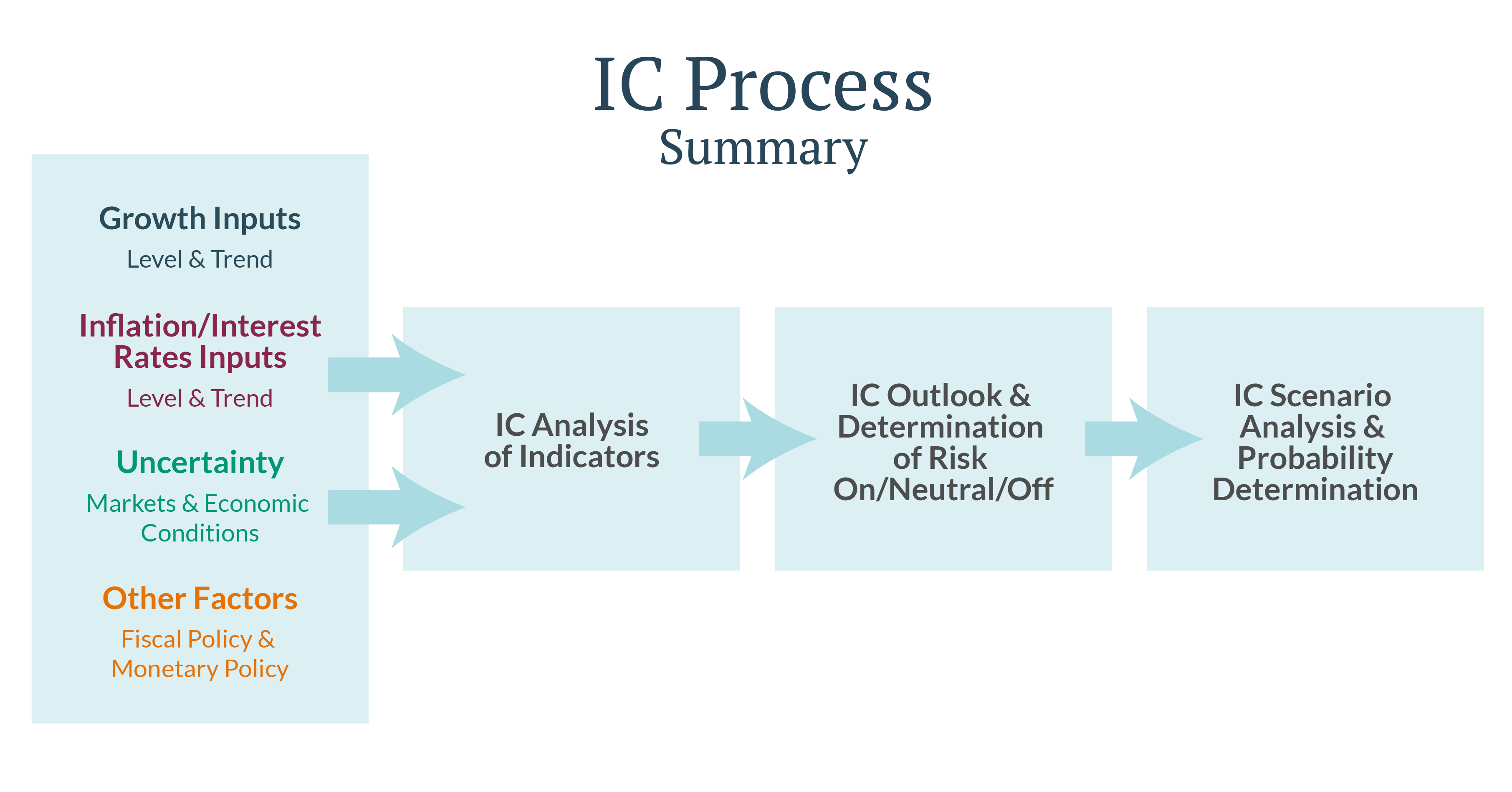

Our investment process begins with our Investment Committee (IC), led by our Chief Investment Officer and including, among others, our Directors of Equity, Fixed Income, Alternatives and Investment Research. The IC reviews economic conditions, including growth and inflation expectations, conducts scenario analysis to stress test portfolios, and determines the appropriate risk posture in portfolios based on highest-probability economic outcomes.

With direction from our Investment Committee, each strategy group (Equity, Fixed Income, and Alternatives) is then tasked with implementing the IC outlook with the goal of outperforming their respective benchmarks. The strategy groups work closely with our research team to choose the appropriate investment vehicles to achieve the group’s goals. No investment product may be employed without the approval of Investment Research, and all investment changes follow key guidelines:

- Strategy groups focus on “core levers.” These are strategic or tactical positioning changes that have a high probability of success based on back tested research.

- Risk analysis is performed before every portfolio change, confirming that positioning is within risk guidelines.

- In most market environments, risk is rewarded, resulting in a bias toward a modest overweight to equities and credit within fixed income.

- Portfolio changes should have a material impact, not activity for the sake of “doing something.”

The core levers employed by each strategy group are key to keeping our process consistent and effective. Following is additional perspective on each.

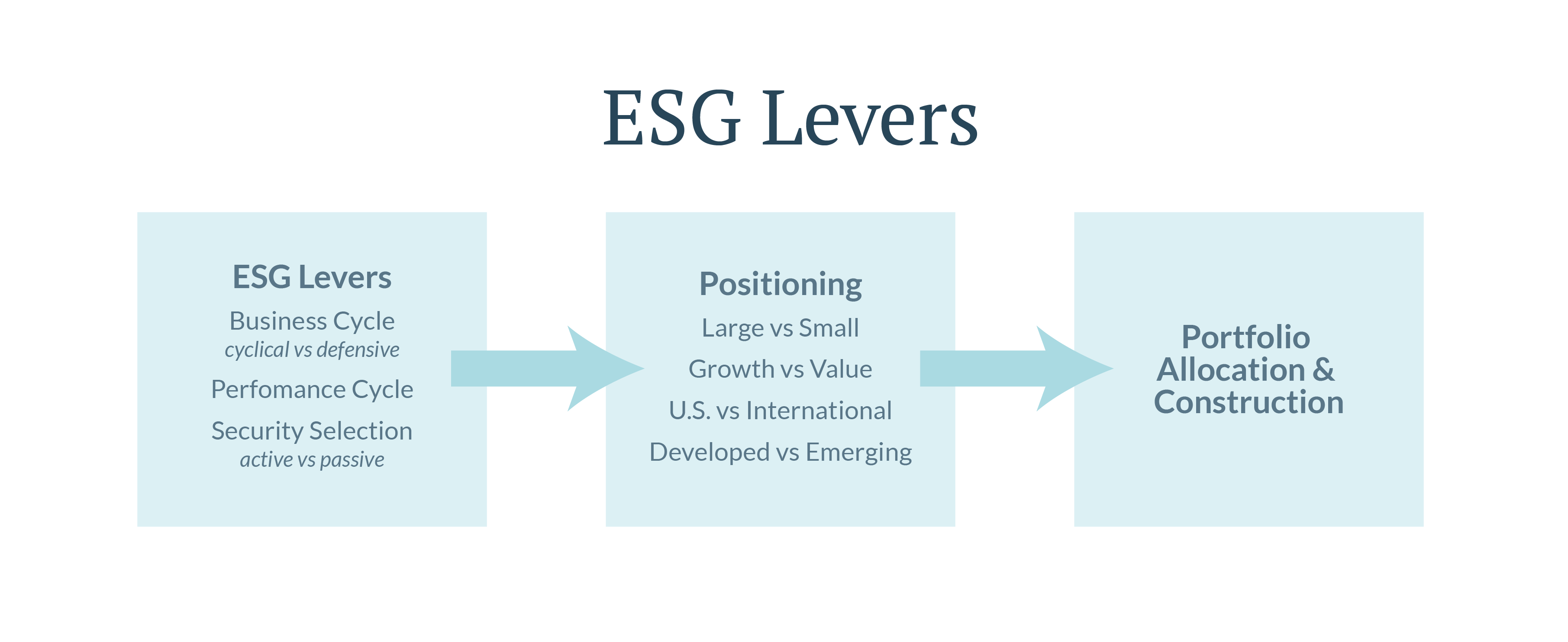

Equities

The Equity Strategy Group (ESG) focuses on three core levers: The Business Cycle, Manager Performance Cycles, and Active vs. Passive investing styles. Where we are in the business cycle informs our quality vs. cyclical equity exposure, and our exposure to large- or small-capitalization companies. Our research shows that active management is more effective in international and small-cap equities, while passive management offers low-cost and tax-efficient exposure to the largest stocks. When allocating to actively managed strategies, we monitor the manager’s performance cycle to reduce exposure after periods of outsized returns and add when a strategy is out of favor as part of our overall rebalancing philosophy.

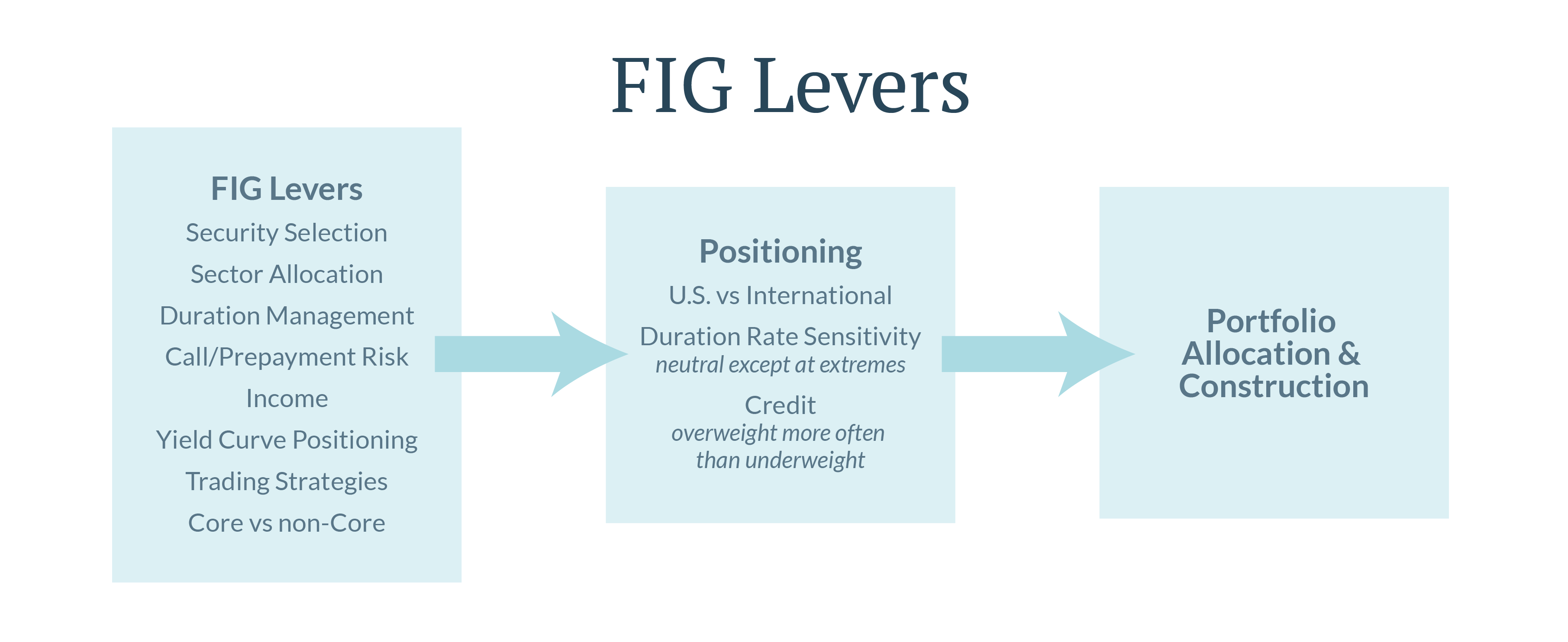

Fixed Income

Our Fixed Income Group (FIG) focuses on a strategic credit (corporate bond) overweight in most environments, and core levers including security selection, sector allocation, duration management and income generation. Our research shows that active management with the disciplined use of these levers has a strong probability of outperforming passive management within fixed income. Our portfolios will typically maintain an income advantage over our benchmarks, which we believe is a critical component of a total return approach to managing fixed income.

Alternatives

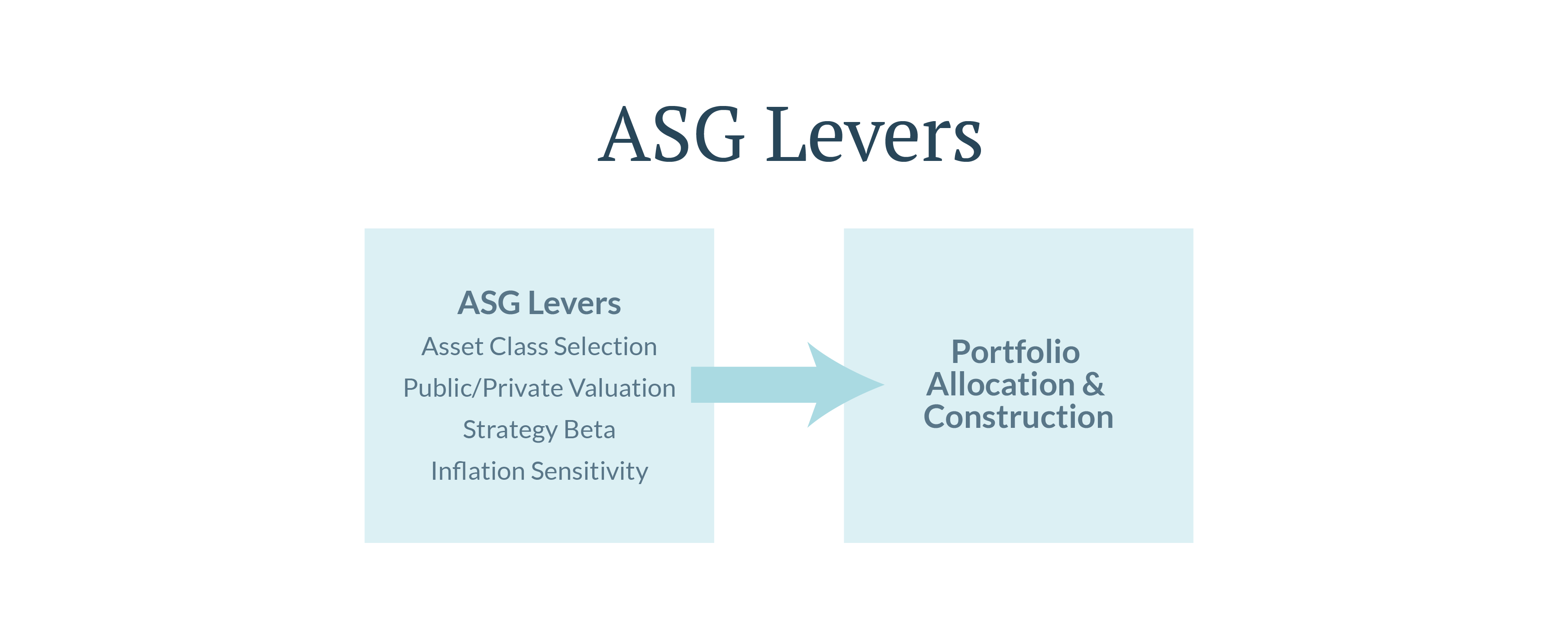

Finally, our Alternatives Strategy Group (ASG) focuses on key levers including asset class selection, public vs. private valuation, and inflation sensitivity.

Two recent portfolio changes demonstrate this well. In response to rising interest rates, our team determined that publicly traded real estate was oversold following a period of negative sentiment focused on the office sector. We made a choice to reduce private market exposure and add to undervalued public real estate to take advantage of the relative value. More recently, our team identified a unique opportunity in the reinsurance market, where skyrocketing premiums in areas affected by hurricanes and other natural disasters offered a compelling risk/reward profile for investors willing to invest alongside insurers.

Rebalancing Discipline and the Human Element

While our strategy groups work to add value in each of their respective areas throughout the year, we believe that one of the best ways to implement a disciplined, research-driven process is rebalancing. Therefore, we have adopted a rebalancing policy that institutionalizes buying high and selling low while managing each client’s tax liability. Our rebalancing guidelines are as follows:

- When markets are down, we add equities

- -10% S&P 500 triggers an IC vote to rebalance to targets

- -20% S&P 500 triggers IC vote to increase equity to maximum overweight

- 3% equity underweight vs target triggers IC vote to rebalance to targets

- When markets are up, we reduce equities

- +10% since last rebalance triggers IC vote to remove any incremental overweight and/or rebalance to targets

- 3% equity overweight vs target triggers IC vote to rebalance to targets

- Rebalancing may be delayed with a simple majority IC vote

Our research suggests that following a consistent rebalancing policy such as this can add as much as 1% to annual returns over the long term.

Emotions Have Their Place

Hopefully, this piece has helped our readers to understand our investment process and the many ways we seek to employ a consistent, research-driven process that reduces the risk of investor (or advisor) emotion pushing us off course. But I think it’s important to close with the observation that emotions are what give life its meaning. A financial plan or successful trade cannot compare with the joy of seeing one’s grandbaby smile or laugh for the first time, and it cannot remove the sting of loss. We believe that our advisors’ secret weapon in this competitive landscape is compassion coupled with knowledge and a sound process. That is what makes us truly different.

This information is for educational and illustrative purposes only and should not be used or construed as financial advice, an offer to sell, a solicitation, an offer to buy or a recommendation for any security. Opinions expressed herein are as of the date of this report and do not necessarily represent the views of Johnson Financial Group and/or its affiliates. Johnson Financial Group and/or its affiliates may issue reports or have opinions that are inconsistent with this report. Johnson Financial Group and/or its affiliates do not warrant the accuracy or completeness of information contained herein. Such information is subject to change without notice and is not intended to influence your investment decisions. Johnson Financial Group and/or its affiliates do not provide legal or tax advice to clients. You should review your particular circumstances with your independent legal and tax advisors. Whether any planned tax result is realized by you depends on the specific facts of your own situation at the time your taxes are prepared. Past performance is no guarantee of future results. All performance data, while deemed obtained from reliable sources, are not guaranteed for accuracy. Not for use as a primary basis of investment decisions. Not to be construed to meet the needs of any particular investor. Asset allocation and diversification do not assure or guarantee better performance and cannot eliminate the risk of investment losses. Certain investments, like real estate, equity investments and fixed income securities, carry a certain degree of risk and may not be suitable for all investors. An investor could lose all or a substantial amount of his or her investment. Johnson Financial Group is the parent company of Johnson Bank and Johnson Wealth Inc. NOT FDIC INSURED * NO BANK GUARANTEE * MAY LOSE VALUE