With the Fourth of July and the corresponding firework displays behind us, it feels appropriate to reflect on the explosive first half of the year in the market. Stocks have defied predictions of an economic slowdown, with the S&P 500 Index up 15% this year (and 30% since the lows of October 2023). Following such a strong run, investors naturally ask, "What action are you taking now?"

While we strive to focus on long-term thinking, our portfolio management discipline also guides us to make adjustments when market movements are overextended (as my colleague Brian Schaefer highlighted in a recent commentary). In keeping with that discipline, we're rebalancing our equity portfolios and repositioning the allocation within US equities to reduce exposure to our "winners," the areas and managers that have outperformed by the widest margin.

For portfolios that include alternative investments, we've also introduced a new asset class, reinsurance securities, into our strategy lineup as of the end of May. We believe that alternatives can play a valuable complementary role in portfolios by providing exposure to unique sources of return, diversifying risk, and improving long-term portfolio outcomes. Alternatives also offer another set of investment tools to consider when markets are uncertain or richly priced, as they are today.

What is Reinsurance?

The centuries-old reinsurance industry exists to provide insurance to the insurance companies offering coverage for natural catastrophes. The most widely accessible way of investing in reinsurance is through catastrophe bonds (often called “cat bonds”). Insurance companies seek insurance for two primary reasons: First, regulators impose strict requirements to ensure their ability to make good to customers in cases of a qualifying event. Second, insurers make judgments about their risk profile across its portfolio of policies and use reinsurance to make adjustments. In both cases, distributing the risk across a broad base of investors allows the companies to better navigate financial shocks of large-scale events.

The reinsurance asset class, though unfamiliar to many investors, reflects many of the desirable characteristics of an alternative investment strategy:

- Consistent Positive Returns. As measured by the SwissRe Global Cat Bond Index, the asset class generated gains in 21 of 22 years since the inception of the index and produced an annualized return of 7.08%.

- Diversification. Returns are independent of financial markets and have demonstrated no correlation to stocks and bonds. In fact, since 2002, the Cat Bond Index has been positive 85% of the months when stocks were negative and 86% of the months when US Corporate Bonds were negative.

Why Now?

Given these risk and return characteristics, as well as due to the current dynamics in insurance markets, we believe now is an opportune time to add the strategy. Reinsurance returns are primarily driven by three inputs:

- The premiums paid by policyholders

- The interest rate earned on the cash from premiums

- The number and severity of events during the coverage period

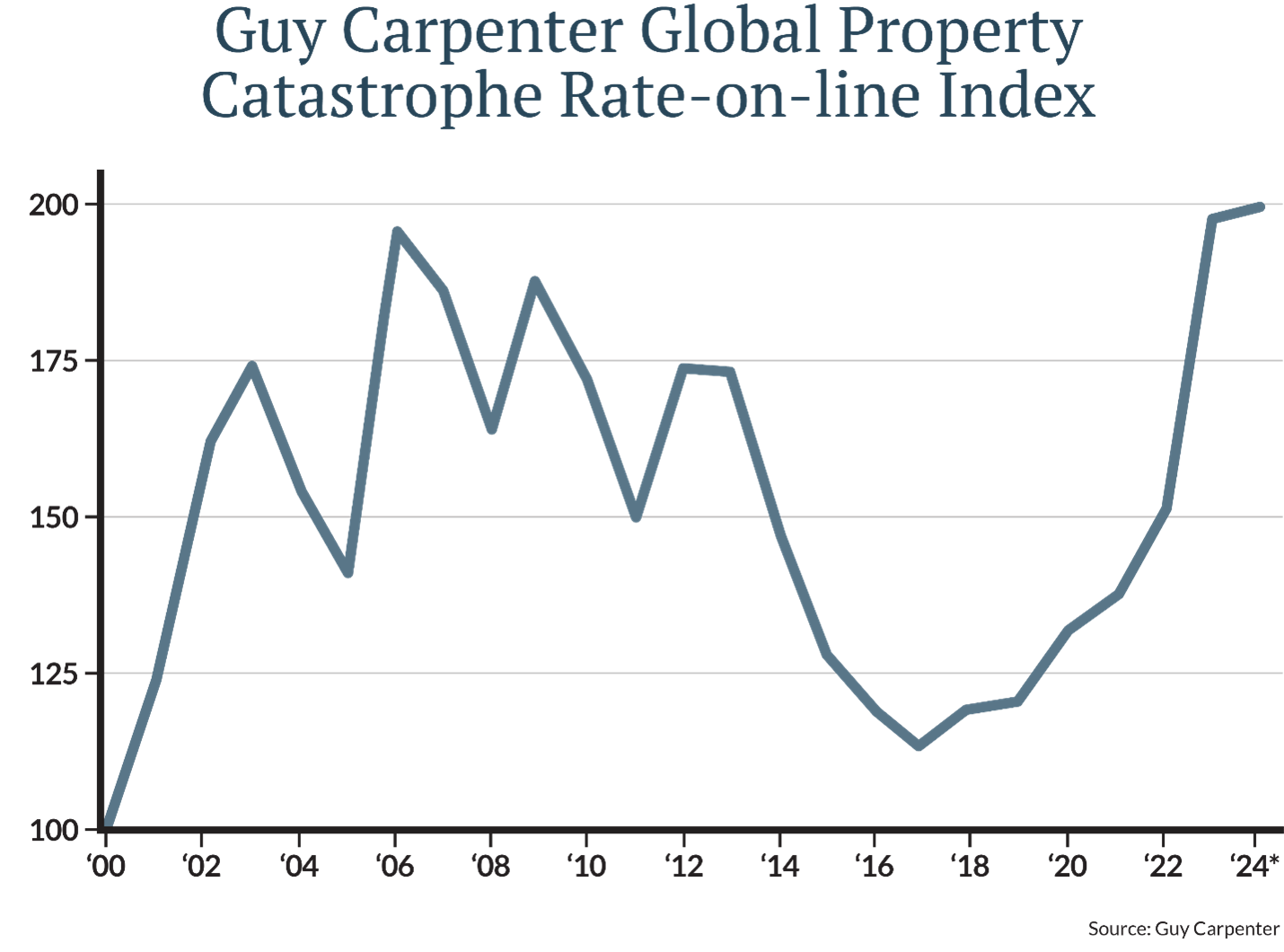

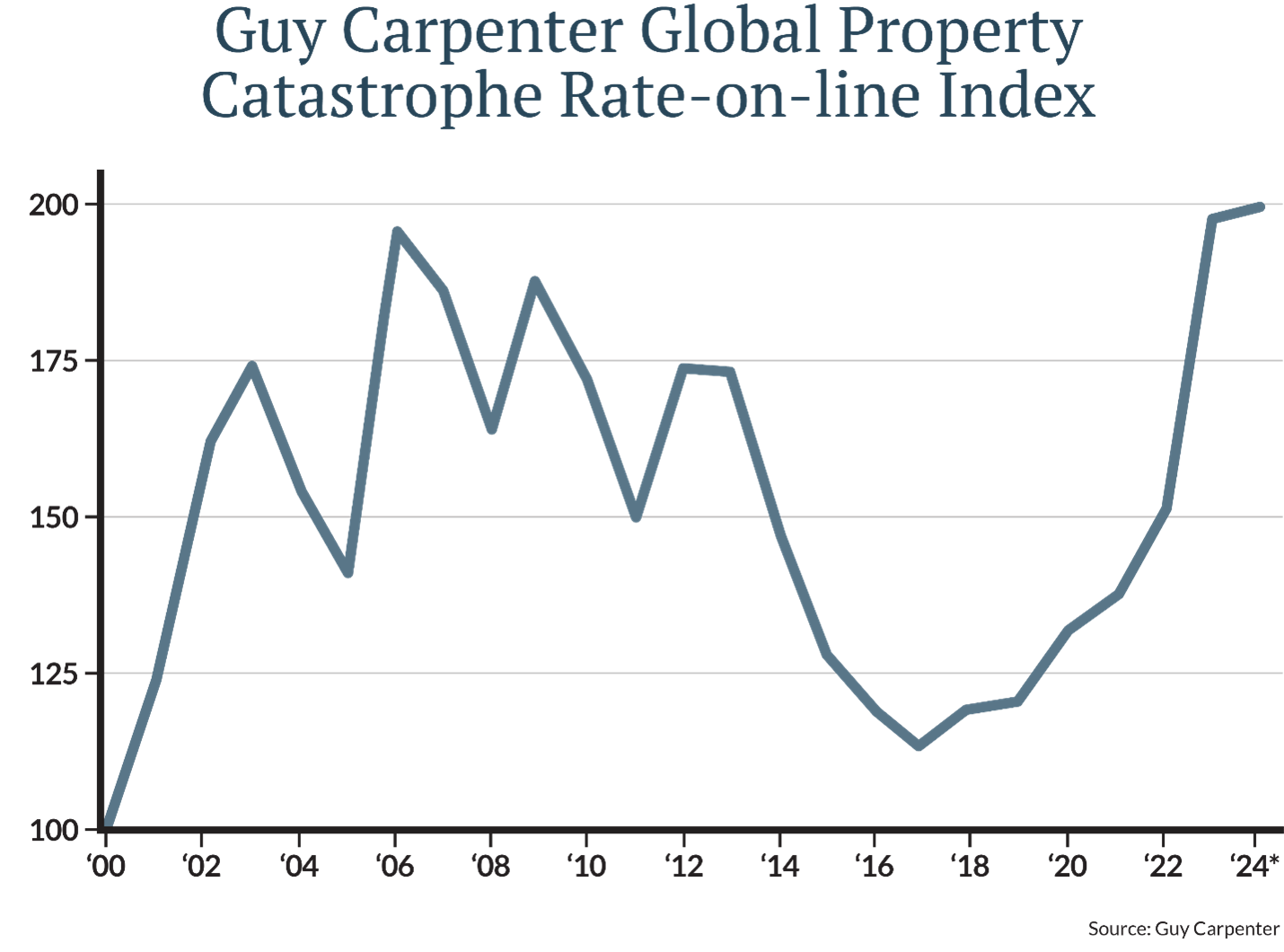

As profit-motivated entities, insurers/reinsurers are incentivized to offer policies only in areas and at rates they believe will generate profits over the long term. The industry experienced several challenging years between 2017 and 2022 due to an overabundance of capital that drove down premiums and large-scale insurable events. The industry has adjusted by demanding record-high premiums for coverage (shown below), withdrawing from areas considered too high risk, and updating forecasting models to reflect climate trends. The results of these efforts, combined with minimal insurable catastrophic events, produced index returns of 19.7% during 2023 and position the asset class for attractive potential returns in 2024.

The remainder of the year has many potentially market-moving events, including possible Fed rate cuts, domestic and international elections, and numerous geopolitical issues. By prudently following our investment discipline and repositioning portfolios, we aim to keep clients on track to reach their goals and a dazzling grand finale worthy of any Independence Day celebration.